A vital evolution that automation has to offer, besides better customer experience and greater profits, is happier employees. For banking, specifically, this technology has freed thousands of workers from mundane and stressful workloads, allowing improved productivity and satisfaction levels.

The booming trend of bank automation

The banker’s job has always been characterized as dull and stressful. Across any financial institution, there are hundreds of repetitive tasks, which hinder employee’s working motivations, yet create a perfect environment for automation deployment.

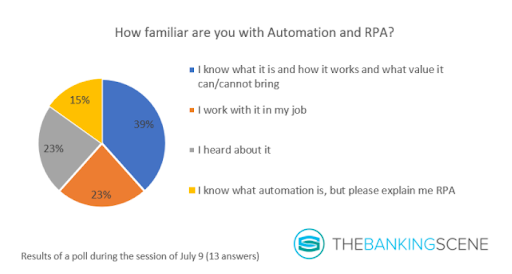

Automation can be basically perceived as minimizing human input. Robotics Process Automation (RPA), for instance, makes use of software robots to automatically process rule-based and time-consuming tasks. In fact, over the past few years, more and more firms in the industry are introducing automation to their operational processes. They are also keeping up with a brand new exciting trend of citizen developers, enabling employees themselves to apply the technology into their daily work and enjoy greater efficiency. According to a recent survey by The Banking Scene, the audience of RPA is shifting from technical to business.

Source: The Banking Scene

In detail, 39% of surveyed people know about RPA and automation and understand what value it can/ cannot offer. An additional proportion of 23% of participants has already worked with the assistance of the technology. It can be concluded that automation in banking is highly potential as the term is gaining its popularity across the sector and an increasing number of people are eager to learn more about RPA.

Automation – The key to banker’s better working lives

Boring jobs no more

A study released by Emolument in 2017 revealed that about 67% of bankers and financial service workers were feeling bored with their jobs. This can be explained by the fact that heavy manual and repetitive workloads can easily strip employees of working inspirations. With the aid of automation, however, this is not the case anymore. The technology is programmed to perform tedious tasks so that humans don’t have to. Employees can, therefore, have more time to get involved in more strategic tasks, which can not only effectively utilize their talents but also bring back higher values to their organizations. Regarding this advantage of a better use of human capital, nearly 4 out of 5 people taking part in The Banking Scene’s survey shared the same view.

Improved accuracy and higher processing speed

Data entry, gathering, and processing are essential tasks for the banking industry, yet prone to human error. Detecting and correcting mistakes can consume much effort of bankers while remaining as an ineffective solution. Banks around the world are turning to automation to minimize manual tasks and avoid those errors. Payment transaction processing, for example, can be performed with a 90% enhancement in accuracy levels by the application of RPA. Moreover, automation’s friendly robot helpers understand that time means money. Consequently, they appear especially helpful to reduce the task processing time by operating 24/7 and improve Turnaround Time (TAT) to seconds instead of minutes. Bankers can now enjoy their jobs with higher work efficiency.

Source: Freepik

Lower stress levels

Bank employees have every reason for feeling pressured: high volumes of tasks, excessive working hours, strict job requirements. You name it. According to a study published in the International Journal of Environmental Research and Public Health in 2018, 25% of surveyed bankers belonged to the high-stress group. By applying automation, banks can relieve their employees from working tension and offer a more friendly working environment. Especially, with solutions requiring no IT background like RPA, bankers can implement technology to their daily tasks effortlessly without any obstacles.

Several pain points exist in the life of a banker, and automation has come to the rescue. The technology is highly flexible and can be applied to multiple banking tasks, from data input, report generation to loan processing or customer onboarding. It is promised to continue accompanying bank employees to complete their work with satisfaction while helping businesses reduce fraud, enhance compliance, and boost customer service.

Sources:

- Are Bank Employees Stressed? Job Perception and Positivity in the Banking Sector: An Italian Observational Study

- Automation is Making Banking More Human Again

- More than two thirds of bankers are ‘bored’ with their jobs