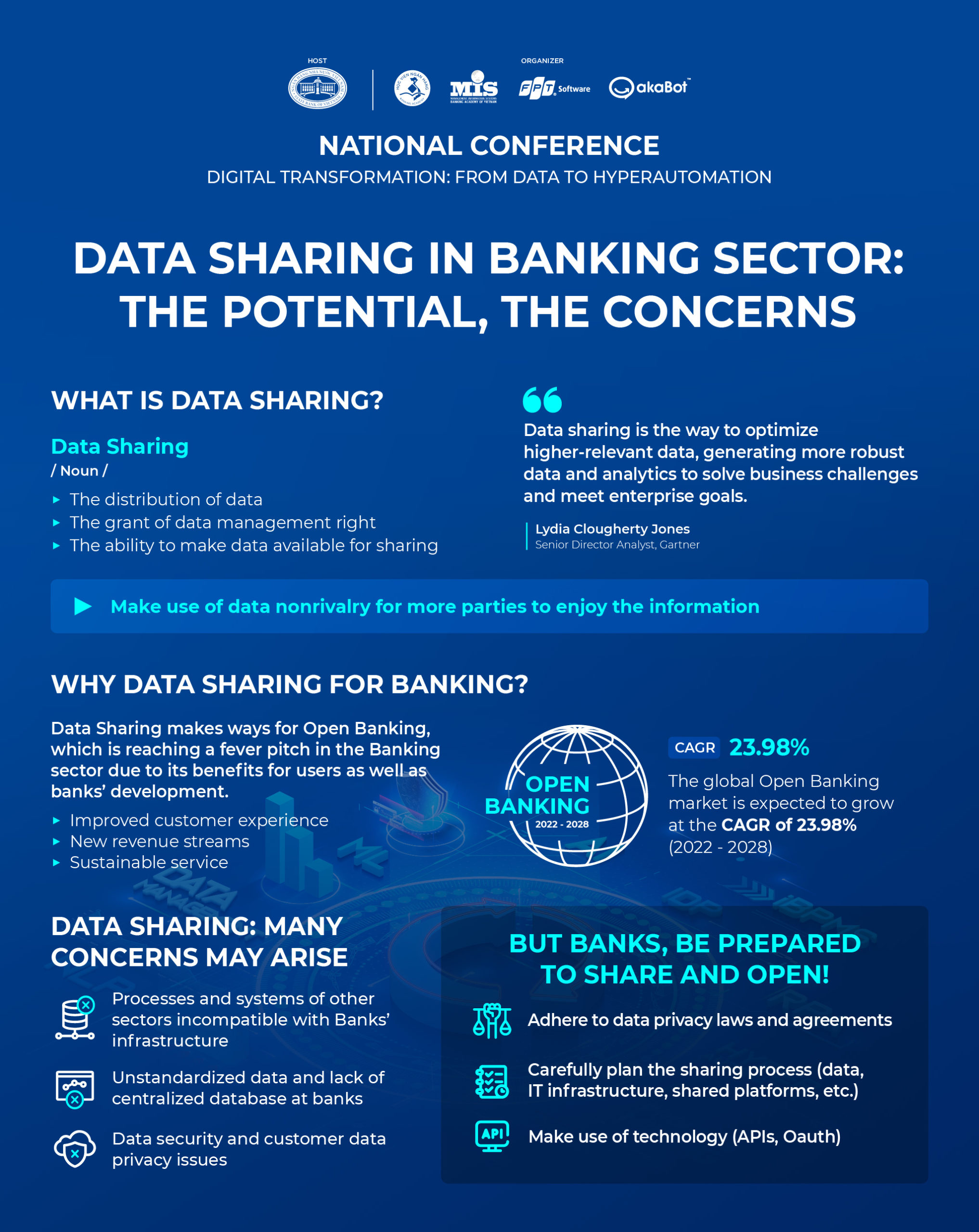

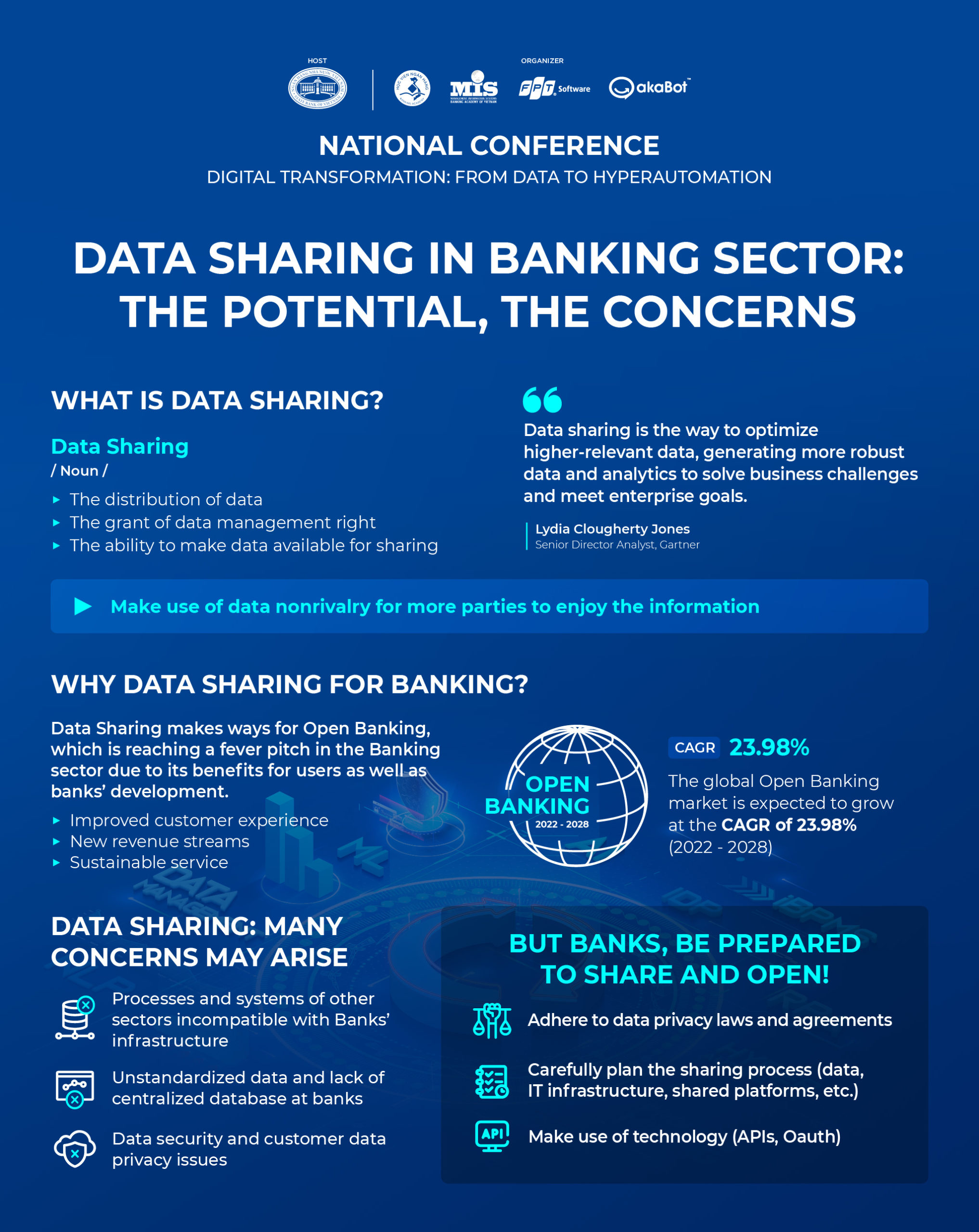

Data Sharing in Banking Sector: The Potential, The Concerns

According to McKinsey, economies that allow data sharing in finance would bring about vast benefits to end-users and financial institutions, while promoting their GDPs to grow 1-5% more by 2030. Open data opens the door for more accurate and effective credit risk evaluation, risk-based pricing, and fraud protection.

Reference:

- Data sharing and open banking

- Financial data unbound: The value of open data for individuals and institutions

- Factors that influence data sharing through data sharing platforms: A qualitative study on the views and experiences of cohort holders and platform developers

akaBot (FPT) is the operation optimization solution for enterprises based on RPA (Robotic Process Automation) platform combined with Process Mining, OCR, Intelligent Document Processing, Machine Learning, Conversational AI, etc. Serving clients in 20+ countries, across 08 domains such as Banking & Finances, Retails, IT Services, Manufacturing, Logistics…, akaBot is featured by Gartner Peer Insights, G2, and ranked as Top 6 Global RPA Platform by Software Reviews. akaBot also won the prestigious Stevie Award, The Asian Banker Award 2021, etc.

Leave us a message for free consultation!

A

Sign Up to Download

Sign Up to Download

February 14, 2020 (v33)

PDF (13.36 MB)

Sign Up to Download

February 14, 2020 (v33)

PDF (13.36 MB)